OUR MISSION:

Help Investors Avoid Bear Markets,

And Live The Lifestyle They Deserve.

You’ve Got One Shot At A Great Retirement.

OUR MISSION:

To Help Investors

Avoid Bear Markets,

and Live The Lifestyle They Deserve.

You’ve Got One Shot At A Great Retirement.

*Exclusive*

Asset Revesting Newsletter

Join 33,103 Investors and Advisors Worldwide to Receive FREE Expert Market Insights, Tools, ETF Signals, and a Bundle of 4 Essential Guides for Mastering Investments and Achieving Richer Retirement (Exclusive Access via Form Submission).

Featured in:

Miss the last major rally?

Worried the market’s topping?

Need a proven strategy to protect your wealth & lifestyle?

Want a different way to invest that produces returns during rising and falling markets?

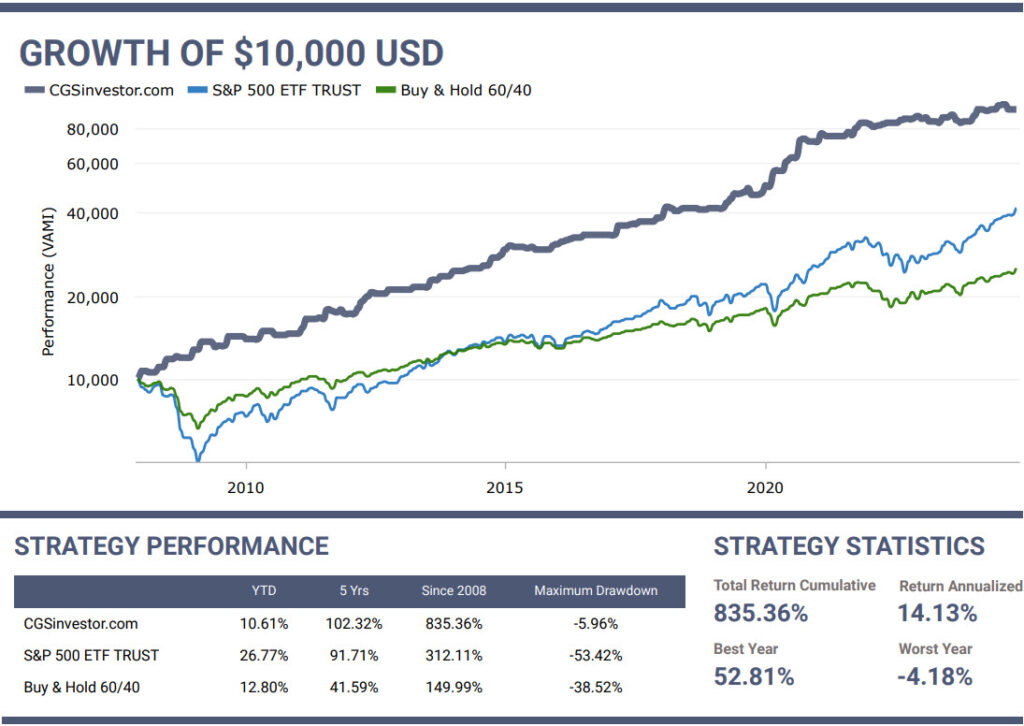

Get 5-12 portfolio adjustments per year and 3x your returns.

Investing Signals & Automated Investing

We are an independent, tactical ETF investment signal alert newsletter that aims to provide you with a proven investment strategy for retirement.

We invest differently. Our unique asset revesting approach is a significant departure from traditional investing. Our consistently profitable Asset Revesting Signals generate reliable, above-average returns with a fraction of the portfolio volatility and risk compared to active trading, the buy-and-hold, and dividend income strategies.

Imagine being able to sell your investments near their peak and then reinvest the money into a different, rising asset. You’d never have to experience bear markets and long periods without returns. Instead, your account generates compound growth leveraging market rallies and declines. That’s what we help you do.

Follow our email investment alerts in your self-directed brokerage account, or have our signals autotraded for you.

Asset Revesting Newsletter

– Worried the market is topping?

– Need a proven ETF strategy?

– Want to protect your portfolio!

– Want to profit from a bear market?

Technical Traders is relied on by individual in over 130+ countries.

Invest Alongside The Founder

Asset Revesting was created by Chris Vermeulen, the founder of TheTechnicalTraders, to manage his money. You can trade alongside the same proven signals and portfolio allocations to ensure financial growth and safety.

How Use Our Signals

You can execute the ETF trades yourself, but missing even one single Asset Revesting signal means missed potential profits. Fortunately, our signals can be automatically executed for you with autotrading or by an advisor.

Asset Revesting Signals

These aren’t regular trading signals. Asset Revesting signals are based on technical analysis, money flow, cycles, and risk management. The 5-12 trades each year provide precise entry and exit signals for maximum profit and simplicity.

Proven Retirement Strategy

Stop relying on slow, volatile strategies that put your investments at risk. If you’re approaching retirement or already retired, asset revesting offers you peace of mind with steady growth and protection for your financial future.

What Investors Say About Our Investment Approach

Logical Research

We are technical analysts specializing in helping you achieve consistent growth and financial peace of mind during market fluctuations. Our continuous assessment of risks allows us to reduce account volatility and keep you on course.

Asset Revesting

Our active approach to investing, portfolio allocation, and position management is different. Our proprietary signals are built around an asset hierarchy and ranking system, allowing you to exclusively hold assets that are rising in value.

ASSET REVESTING BOOK

Print / Digital / Audio

ASSET REVESTING is a game-changing investment style that the financial industry doesn’t want you to discover.

This innovative approach reveals untapped opportunities, and the often-overlooked realities of the investing world while addressing financial problems that you aren’t even aware of.

Whether you’re a passive investor, active trader, busy professional, or retiree seeking above-average returns without having the volatility and significant losses you experienced in the past, Asset Revesting is your solution. If you struggle to control your emotions, and need a proven ETF strategy to follow or have traded for you, then this is the breakthrough you’ve been waiting for.